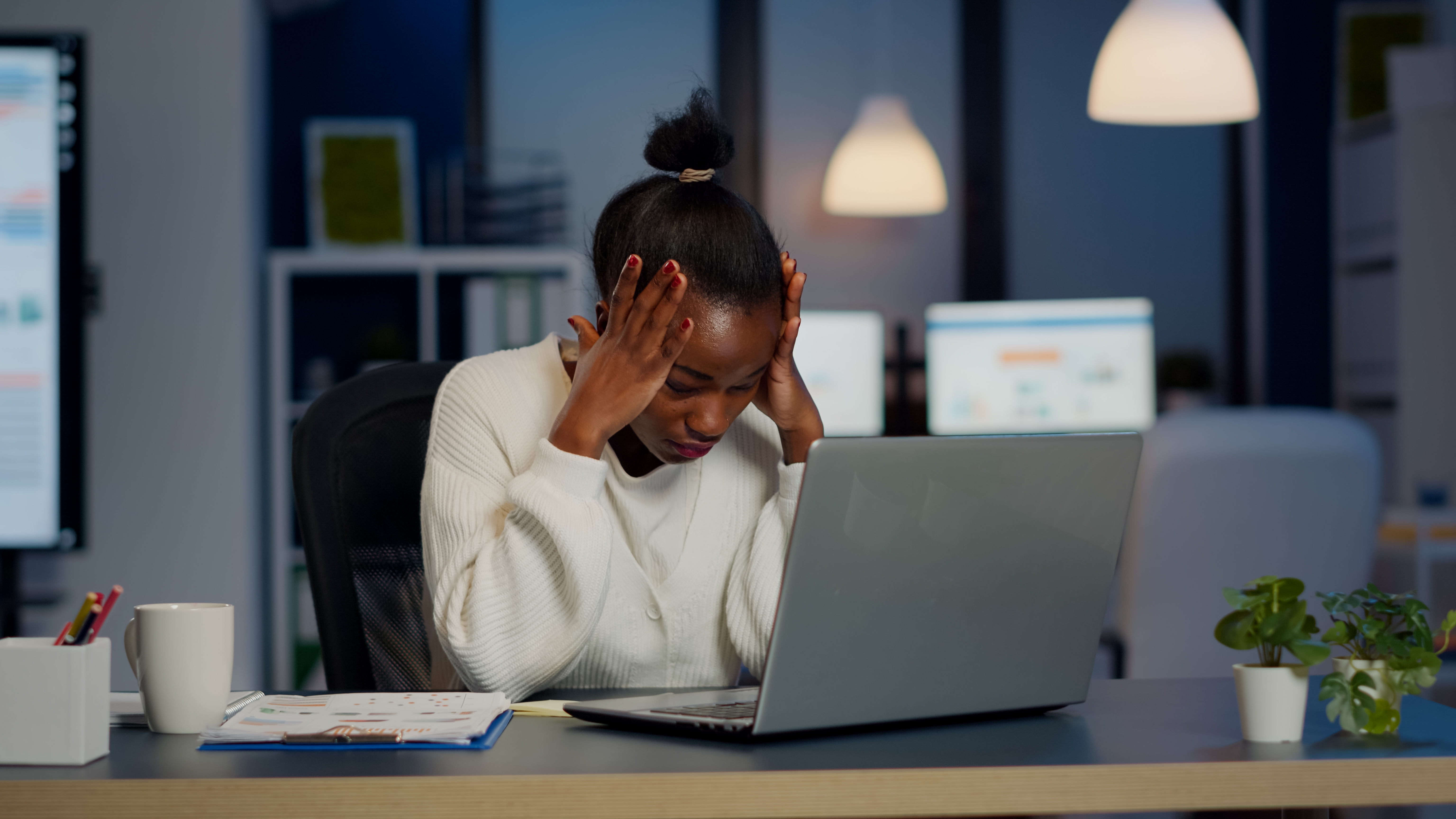

A Call to Financial Professionals During Mental Health Awareness Month

May is Mental Health Awareness Month, a time to spotlight the critical connection between mental well-being and every facet of life—including finances. Financial professionals are often at the intersection where money meets emotion. Behind every balance sheet, retirement plan, or portfolio rebalance, there’s a human being navigating stress, uncertainty, and sometimes shame.