SEC Chairman Michael Piwowar speaks out about the "terrible, horrible, no-good, very bad" Department of Labor Fiduciary Rule.

Topics: Financial Advisors, Department of Labor, DOL Fiduciary Rule

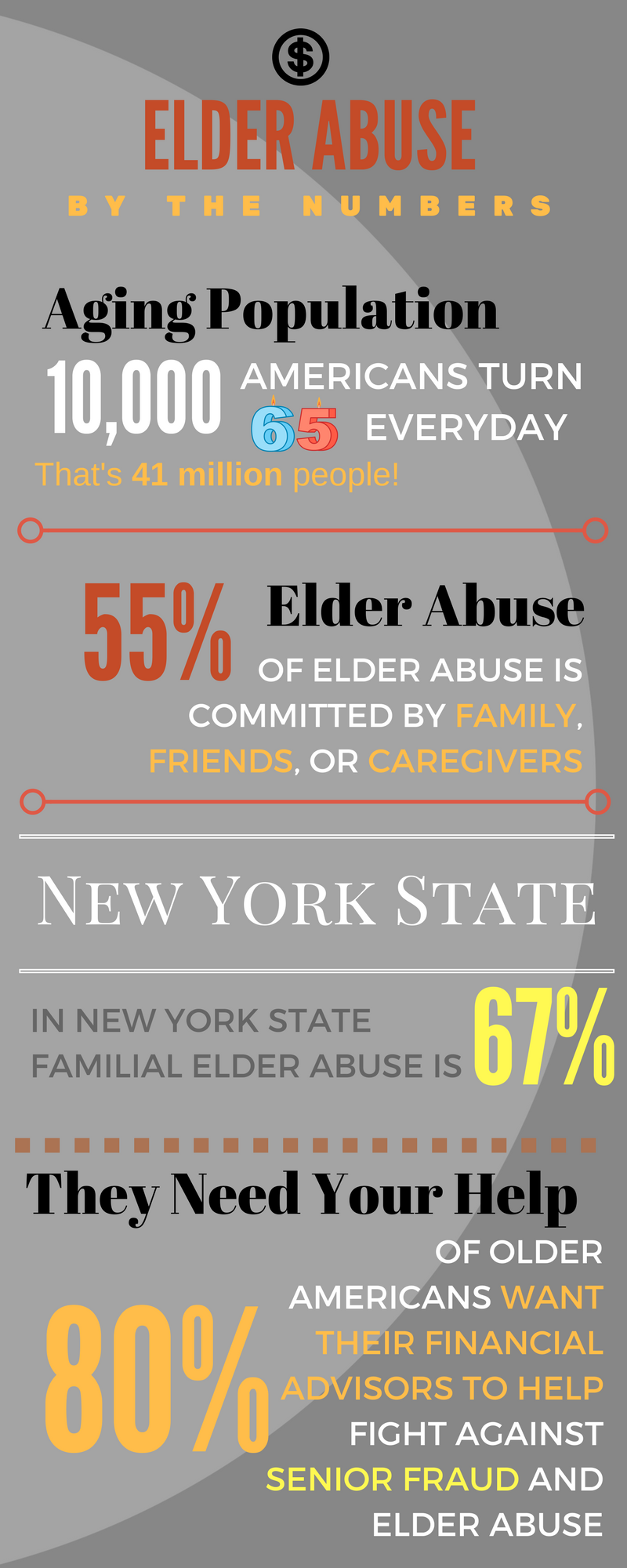

Elder Abuse is increasingly becoming an issue that Financial Advisors need to prepare for. As our clients get older, they are more and more vulnerable to a host of abuses that can cause huge losses to assets which can severely hurt a Financial Advisor’s book of business and open up to possible legal trouble. We’ve created a list of the ways Elders can be abused so that you can stay informed and proactive against scams.

Topics: Financial Advisors, Elder Abuse

LinkedIn can be a great resource for finding prospective clients and expanding you professional network. While it is simple to set up an account, you may be missing some key elements that can make sure your profile does not get lost in the crowd.

You created a LinkedIn profile in hopes to expand your professional network and grow your business. Just setting up a LinkedIn account is not enough, with over 400 million professionals on LinkedIn and 122 million in the US alone, you will need to know some tips and tricks to make your profile stand out.

Topics: Social Media, LinkedIn, Financial Advisors

7 Reasons Financial Advisors Should Say Goodbye to Paper

Implementing a paperless initiative in your practice can increase efficiency in a big way. Utilizing a straight through processing system with electronic documents and signatures will decrease time, human error, storage, and (undoubtedtly) headaches.

Many businesses hesitate to invest time, effort and money in modern technology that would improve the overall work flow in operations. In the broker dealer world, constant regulation changes and FINRA guidelines amend the way paper is handled and archived. In turn, Financial Firms are challenged with strenuous compliance requirements to make certain all documents are accounted for and signed appropriately.

Topics: Financial Advisors

While the industry is ultra focused on Millennials inheriting Baby Boomer money and taking over the market in big way, many advisors are forgetting about the demographic that is at the peak of their earning years right now – Generation X.

This generation makes up 60 million people. This is a huge demographic for the financial industry which is why financial planners need to start paying more attention to this “forgotten generation” as Investment News calls it. Gen Xers are skeptical to invest due to the 2008 financial crisis and even more suspicious of hiring a Financial Advisor, fearing they will be taken advantage of. According to a 2014 Allianz Life Survey, 75% of Gen Xers believe financial advisors are just out to sell them something and make money for themselves. It's possible to turn this stat around if you understand their financial pain points and speak their language.

Topics: Financial Advisors