Vanderbilt Financial Group

Founded in 1965 and located in Woodbury, NY, Vanderbilt Financial Group is the “Sustainable Broker Dealer.” The firm is the first Independent BD committed to investing with purpose. Through Impact Investments the firm offers investments in socially and/or environmentally responsible, ethical, and impactful opportunities. In 2014 the firm was recognized with the MAP Vital Factors Solutions® Presidential Award for achieving excellence through implementing the MAP Management System™. Vanderbilt’s refreshing, unique, and progressive culture is a driving force to continue to be innovative constantly striving to positively impact their community.

If you’re like us, you rejoiced last Friday (Feb 3, 2017) as you watched President Trump sign the Executive Order effectively taking a stand to dismantle the DOL Fiduciary Rule that has been on the minds’ of Financial Advisors across the country for over a year. We sighed a sigh of relief as we thought eliminating the impending rule would save us headaches, hurdles, and “Unintended Consequences”.

Read More

Topics:

DOL Fiduciary Rule

In our blog series on elder abuse (“Elder Abuse: Avenues of Attack”) we brought to light the issue of elder abuse and how it can affect a Financial Advisor’s practice. In our second installment (“How to Protect Your Clients and Your Business Against Elder Abuse”) we mentioned some strategies of protection, briefly mentioning the Senior$afe Act. This bill, if passed by congress, can hugely help to protect advisors, so here are the things you need to know.

Read More

Topics:

Senior$afe Act,

Elder Planning,

Elder Abuse

In just the first few days of Donald Trump’s Presidency, the Dow Jones broke a 120 year record. On January 25th the Dow surpassed 20,000 sparking rejoice on the floor of the NYSE and the trending hashtag #dow20k.

Read More

Topics:

DOW 20k,

Donald Trump

In last week’s blog post, “Elder Abuse: Avenues of Attack” we highlighted ways that elder clients are vulnerable to being abused and taken advantage of. We outlined the avenues of attack so that you can now identify red flags when they arise and take action to protect your clients and your business.

Read More

Topics:

Elder Planning,

Elder Abuse,

FINRA

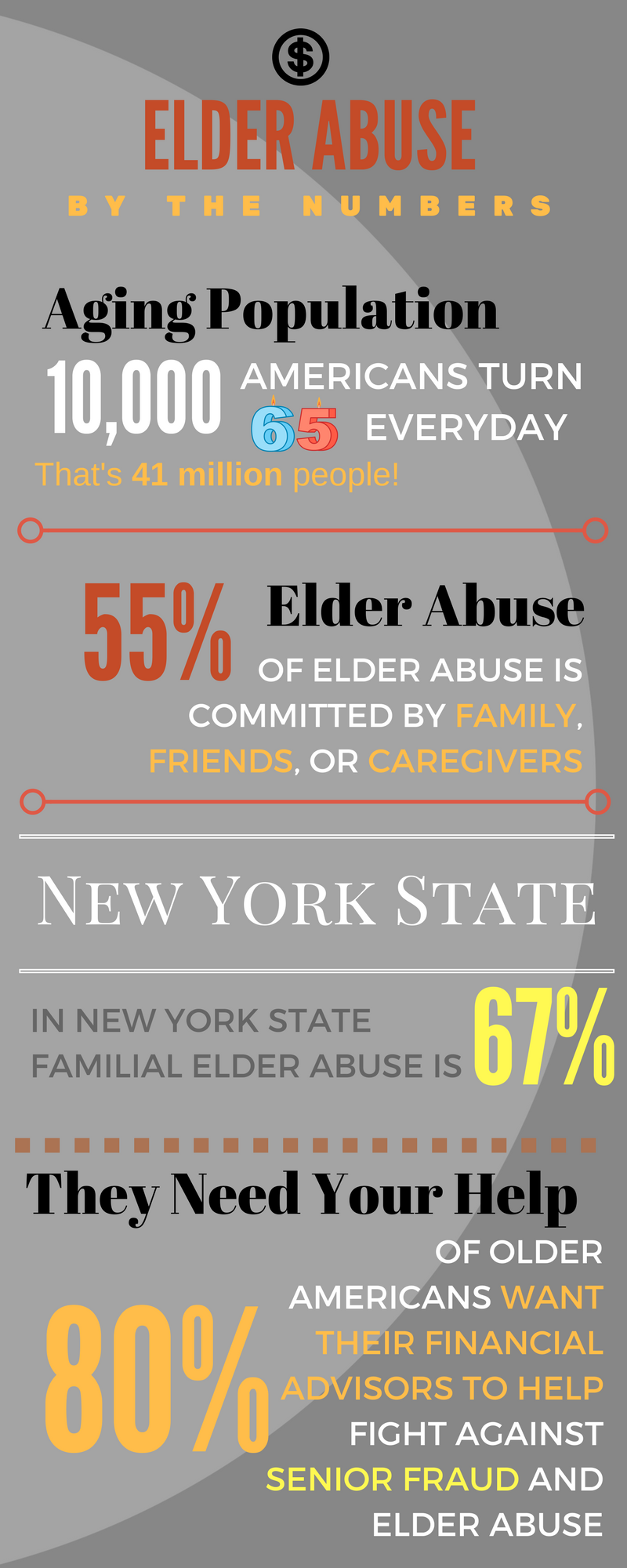

Elder Abuse is increasingly becoming an issue that Financial Advisors need to prepare for. As our clients get older, they are more and more vulnerable to a host of abuses that can cause huge losses to assets which can severely hurt a Financial Advisor’s book of business and open up to possible legal trouble. We’ve created a list of the ways Elders can be abused so that you can stay informed and proactive against scams.

Read More

Topics:

Financial Advisors,

Elder Abuse

.png)