Lisa Roth, of Monahan & Roth, LLC has been Vanderbilt’s key compliance consultant for many years and currently serves on several FINRA boards. This October she was the Keynote Speaker at Vanderbilt’s 2016 Annual Sales and Compliance Meeting. Her presentation, “Just the Fact’s Ma’am” focused on the DOL Fiduciary Rule and what it means for Financial Advisors. Here were just some of the highlights of the best rated talk of the day:

What does the DOL really mean?

“Under the DOL rule you are required to provide recommendations in the best interest of your clients, free of all direct or indirect conflicts of interest.”

What is considered a recommendation?

A recommendation includes both the decision to move assets as well as how to invest them:

- Advising on buying, selling, or holding retirement investments

- Recommendations of a third party investment manager for retirement assets

- Advising on taking a distribution of assets from a plan, including assets to be distributed / rolled over from a plan or IRA.

- Whether to, in what amount, in what form, and to what destination.

New Glossary for Retirement Assets:

Fiduciary Standard -

- Must act in client's best interests

- Under DOL Fiduciary standard, conflicts cannot be cured through disclosure

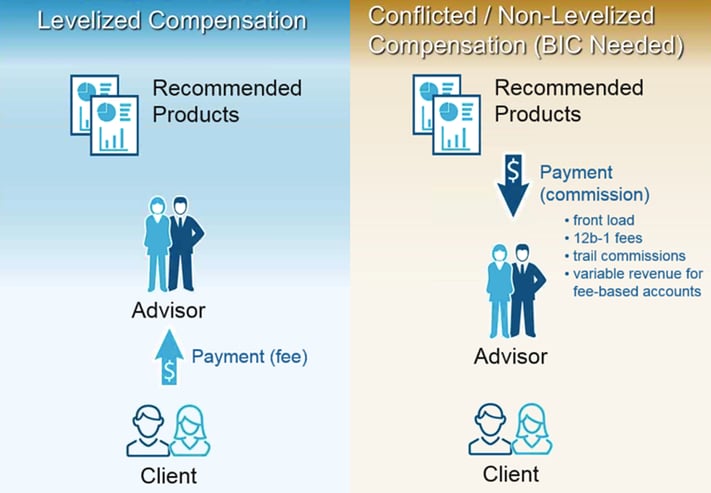

Conflicted Compensation -

- Investment products that compensate the advisor (or firm) differentially create a conflict of interest

- The advisor must eliminate the conflict through level fees or utilize an exemption (e.g. BIC)

Level Fees -

- A level-fee account can be used to ensure that potential investments do not compensate the advisor differentially, removing conflicts

Best Interest Contract (BIC) Exemption -

- A binding written agreement allowing differential compensation but requiring significant disclosures, contractual liability, and that all advisor recommendations be in client’s best interest

Key Issue = The Method of Advisor Compensation

We hope you found this guide helpful. As part of Vanderbilt’s dedication to monitoring the situation, staying educated, and exploring options, we’ve continued to share helpful blogs like this. Check out some of our other thoughts on the DOL like; “The DOL Fiduciary Rule and The Law of Unintended Consequences”, “DOL – A Strategic Plan”, and “How Will The Election Results Affect The DOL Fiduciary Rule?”