Measurable Impact and the lack of an ESG Standard

In a discussion on our sister site Impact U had with Joan Trant, Managing Partner at TriLinc Global, Joan emphasized that if done correctly, impact investing can yield scalable products and deliver risk-adjusted market-rate returns with disciplined operations and compliance processes. At the same time, this against-the-status-quo type of investing has the potential to generate a positive, measurable impact on the environment, socially, and the standards to which our companies are governed.

So, how do you generate that “measurable impact”? As Incofin CEO Loïc de Cannière puts it, "If the impact is defined as improving the living standards of people affected by a particular investment, the management needs actually to measure the living standards." The issue is, because of the variability in measuring this type of data, ESG criteria have not yet become standardized. Data vendors have variability and opinions on a theme. To measure the impact, we need more reliable measurements. As of now, no single approach would work with all funds, all companies, all industries. A standardized measurement is difficult to accomplish because different industries find different data points more material than others. A survey of the existing data vendors and ESG products out there can confuse anyone as to the method one should take.

While we may be a little way off from agreed-upon data points, it is helpful for investors to know two of the leaders in industry-specific reporting that we do have today and understand how their methodology may be material for their own impact investment decision-making.

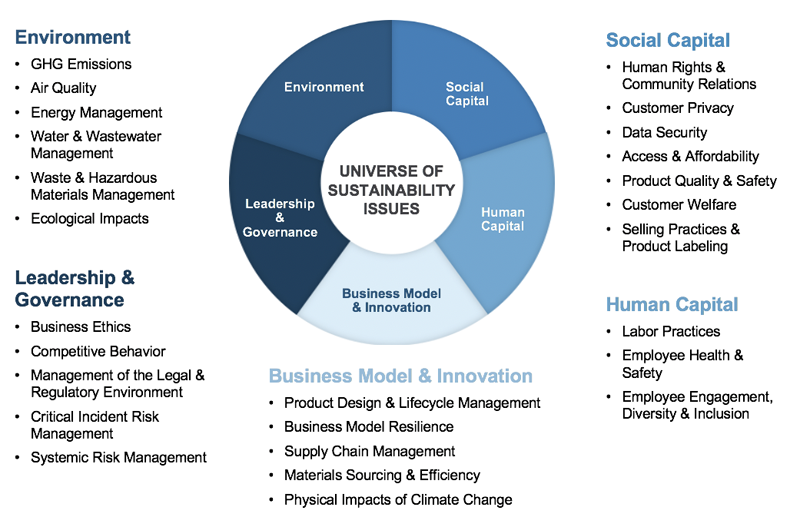

Figure 1. SASB's Five sustainability dimensions. Source: SASB

The Global Reporting Initiative (GRI)

The Global Reporting Initiative (GRI), launched in 1997, is the first global standard for sustainability reporting. Their set standards are free and open to public use by any company or organization. The GRI is widely used today by organizations and companies in over 90 countries for their annual impact reports. According to their website, the “GRI helps businesses and governments worldwide understand and communicate their impact on critical sustainability issues such as climate change, human rights, governance, and social well-being. This enables real action to create social, environmental and economic benefits for everyone. The GRI Sustainability Reporting Standards are developed with true multi-stakeholder contributions and rooted in the public interest.” The GRI is catered to a broader spectrum of industries and helps to standardize data through clustered industry specific measurements. The KPMG Survey of Corporate Responsibility Reporting 2017 found that "63 percent of the largest 100 companies (N100), and 75 percent of the Global Fortune 250 (G250) reported applying the GRI reporting framework." This is an excellent sign that companies are beginning to be more transparent about their social, environmental, and governance impact.

Sustainability Accounting Standards Board (SASB)

The SASB (Sustainability Accounting Standards Board) Materiality Map® is an interactive tool that identifies and compares disclosure topics on Financial material ESG factors across different industries and sectors. SASB works within financial regulations to educate investors interested in ESG factors within their investment decisions. SASB uses five dimensions to develop its standards for publicly traded U.S. companies: Environment, Leadership & Governance, Social & Capital, Human Capital, and Business Model & Innovation.

The main question they seek of ESG data is to determine what’s most "material" to their analysis. According to a panel of lawyers and experts at the 2017 SASB Conference, the material is "any information that could be significant to an investor making an investment in a company or making a voting decision."

Many large companies have adopted the SASB framework, such as JetBlue, the sixth-largest U.S. aviation company. JetBlue was the first to generate a 22-page SASB report in 2016 —disclosing topics for airlines such as Environmental Footprint of Fuel Use, Accidents, and Safety Management, and Labor Relations. Real estate investment trust Host Hotels & Resorts, which owns the iconic Marriott Marquis in New York's Times Square, included energy efficiency and water usage metrics in its SASB report. More recently, SASB has created an Investor Advisory Group with $21 trillion assets under management committed to improving the quality and comparability of sustainability-related disclosure to investors. As of March 2018, the Board included big names such as Bank of America Merrill Lynch, Fidelity, Calvert Investments, BlackRock, and Morgan Stanley, to name a few.

At the World Impact Investing Forum 2019, some of the challenging questions posed by 1500 Impact Investing Professionals were: “Which effects to measure? How do we measure them? What are the practical and cost considerations involved in executing this measurement? How do we update and execute ongoing measurement?” As concerns regarding ESG measurement and benchmarking unfold, more efforts in partnerships amongst data vendors and reporting organizations could provide more standardized methods of calculating ESG. In a growing industry such as Impact Investing, time can only tell where ESG data will end up.

Are you an Advisor who is passionate about Impact Investing? Vanderbilt Financial Group is known as “The Sustainable Wealth Management Firm” for our commitment to providing Financial Advisors and their clients greater access to impact-oriented products and services. Join our growing firm and make a positive impact on the world.

Joseph Trifiletti is the Chief Operating Officer of Vanderbilt Financial Group and a driving force behind the firm's success. Joe has been with VFG since 2006. He holds Series 7, 66, 24, 53, and 4 securities licenses and is an alum of Farmingdale State University.

Joseph Trifiletti is the Chief Operating Officer of Vanderbilt Financial Group and a driving force behind the firm's success. Joe has been with VFG since 2006. He holds Series 7, 66, 24, 53, and 4 securities licenses and is an alum of Farmingdale State University.