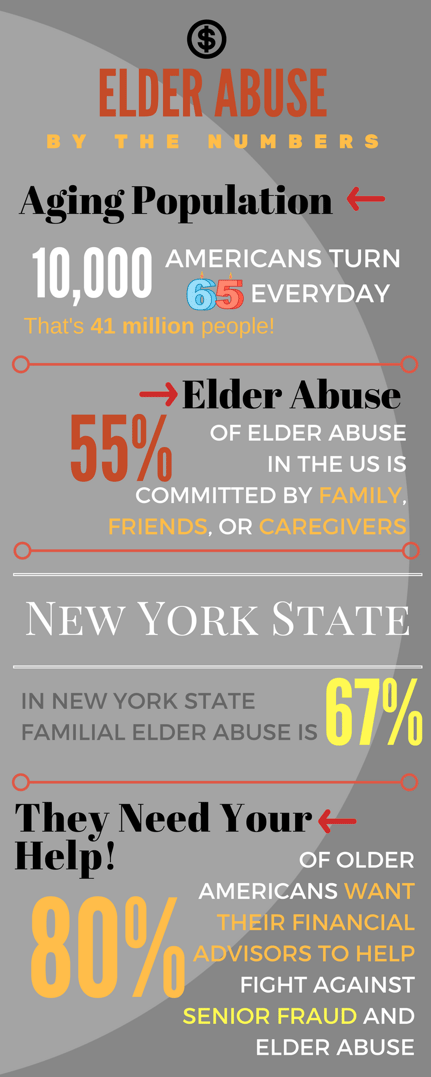

Elder Abuse is increasingly becoming an issue that Financial Advisors need to prepare for. As our clients get older, they are more and more vulnerable to a host of abuses that can cause huge losses to assets which can severely hurt a Financial Advisor’s book of business and open up to possible legal trouble. We’ve created a list of the ways Elders can be abused so that you can stay informed and proactive against scams.

Now that we’ve got your attention –

Think about how many of your clients are nearing or over 65. If you’re like many Financial Advisors, this could very well be the majority of your book. People who are over 65 are often targeted and are extremely vulnerable to scams.

Protect Yourself

Protect yourself by staying informed, proactive, and prepared. We’ve put together this list of the some of the ways elders can be taken advantage of so that you can train yourself to be observant and give special attention when needed.

AVENUES OF ATTACK:

- Undue Influence from family, friends, or caregivers.

- Example: "Mom you can live in my basement but I need money for renovations, can I get a loan?"

- Power of Attorney Abuse

- Price Gouging

- Example: We saw this a lot with Hurricane Sandy

- Medicare and Health Insurance Scams

- Example: Medical discount cards, counterfeit prescription drugs

- Affinity Fraud

- Example: Scammers prey on religious community members

- Charity Fraud

- "You've Won!" Campaigns

- Grandkid Scams

- Example: A phone call comes from a scammer claiming to be a grandchild studying abroad or stuck in jail in need of money immediately.

- Home Repair Fraud

- Imposters pretending to be:

- The IRS

- Tech Support

- Acquaintances

- Online Dating Scams

- Deed Theft & Foreclosure Rescue Scams

In every scenario above, you clients are vulnerable to loosing immense amounts of money. If you take steps to protect your client's you are in turn protecting yourself. When you step in to help in a bigger role, they will appreciate your services by giving you more business and referrals.

Check back next week to for the second part of this Elder Abuse blog which will give you more strategies to protect yourself and grow your business.